Annual Tax Statements are Now Available in Digital Banking

If you are signed up for digital banking and have set up to receive eStatements then you can access your tax forms right now by following the steps below:

- Log into digital banking

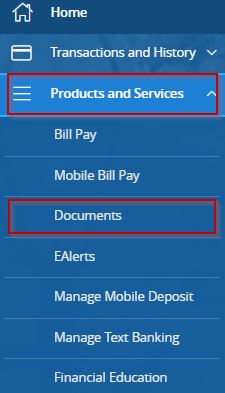

- Select Products and Services from the menu

- Then select Documents

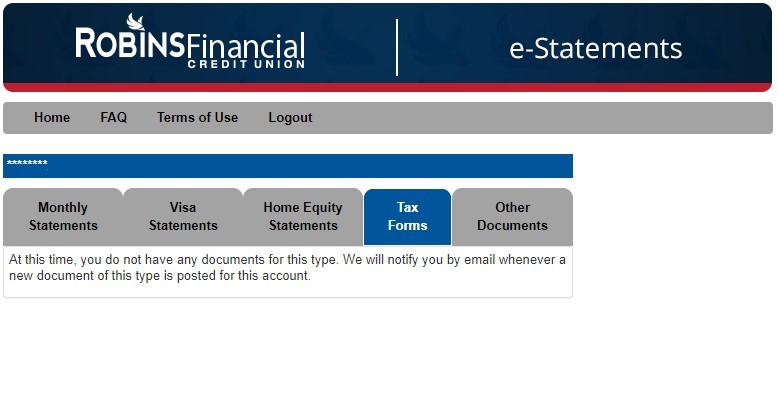

- When the eStatements portal loads up you will select tax forms and select the form that you are looking for.

If you are not signed up for eStatements, all tax documentation was sent out prior to January 31st and will be received via mail. For information on individual tax forms please see the drop downs below, also you can contact your tax advisor or visit IRS.gov.

IRA Tax Forms

1099R – Sent to members who received a distribution from their IRA. This will give the total amount distributed and the amount of Federal Taxes Withheld, if applicable. If the member has a Roth and a Traditional IRA, they may receive one for each IRA type.

5498 – Provides the Fair Market Value (FMV) of the IRA as of December 31st of the previous year. Also lists any contribution amounts, conversions, re-characterizations and Required Minimum Distribution. The 5498s are mailed twice, once in January and once in May to allow for the reporting of any contributions for the previous year between January 1 and the tax reporting deadline (usually April 15). If the member has a Roth and a Traditional IRA, the member may receive one for each IRA type

5498-ESA - Lists any contribution amounts made to the ESA during the tax year. The 5498s are mailed twice, once in January and once in May to allow for the reporting of any contributions for the previous year between January 1 and the tax reporting deadline (usually April 15).

Mortgage Forms

1098 – Mailed to our members who paid mortgage interest. If you have a Fixed Equity Loan or a VISA Equity, you must have paid more than $600 in interest to receive this form for these loan types. You may receive one form for your mortgage and another form for the equity loans. Note: If you have had a Fixed Equity and a VISA Equity during the same year, you must have paid more than $600 in interest on each loan type to receive forms. A form will not be produced based upon the aggregate amount of interest paid. If this is the case, you may reference your monthly statements and add up the interest paid each month or use your year-end statement.

Account Forms

1099-C - Members who have had debt owed cancelled or discharged by the credit union during the tax year. This is reported for cancelled debt of $600 or more. This is per loan/share.

1099INT – Members who earned more than $10 in dividends, or redeemed Savings Bonds will receive this form. This will be an aggregate total.

1099-NEC – Mailed to vendors the credit union has contracted with to provide services to the credit union. For example lawn maintenance, construction, etc. Amount reported to the IRS is $600 or more.

1042-S – Non Resident Members who earned more than $10 in dividends. This is per share, not aggregate. Members may receive more than one.

1099-MISC – Members that the credit union has paid more than $600.00 in miscellaneous income.

*All of these forms are mailed in January and are typically available in digital banking when they are placed in the mail.