Help Desk/FAQ

Select a topic

Wire Fees

Code wire: $8.00 Domestic: $15.00 International: $35.00

Wire Requirements

Cut-off times are 2:00 PM EST for Domestic and International Wires

Contact the financial institution where funds are being sent to obtain proper wiring instructions. The following information must be included:

Domestic Wires

- Financial institution name & ABA/Routing Transit Number (must be 9 digits).

- Further credit name & account number (if applicable). For example: mortgage company, brokerage firm or corporate bank.

- Final credit name, address & account number for the person/company to whom the funds are being given.

International Wires

- International bank name, address & Swift/BIC/Sort Code.

- Final credit name, address & account number for the person/company to whom the funds are being given.

- IBAN: when required.

Still need more information? Contact Us

You may make a withdrawal or deposit to personal savings or checking account, transfer funds from personal savings or checking account, make certain loan payments, or obtain an advance from a line of credit. Please be prepared to provide the shared branch representative with your member number and a valid form of identification. If you do not know your member number you can visit a branch or contact us at 478-923-3773 or 800-241-2405.

Contact Robins Financial directly for specific account information about your account (checks cleared, copies of items) or to conduct other transactions.

Still need more information? Contact Us

You may apply for a loan using our secured loan application, by visiting any of our branch locations, or by contacting our Call Center. Our current rate information can be found here.

Still need more information? Contact Us

Yes, we do consolidate loans. If you would like more information on a consolidation loan please visit a branch or contact us at 478-923-3773 or 800-241-2405.

You may apply for a loan using our secured loan application. Our current rate information can be found here.

Still need more information? Contact Us

While we do accept payments by mail at the address below, the easiest and most convenient way to make your payment is online through our web payments portal. Register today and make one-time, or set up recurring payments to your loans at Robins Financial.

Robins Financial Credit Union

PO Box 7919

Warner Robins, GA 31095

Please verify that check(s) mailed are properly endorsed with your signature on the back, include your account number and the account type to be credited. Additional information or instructions should be noted with an enclosed letter.

Still need more information? Contact Us

For information regarding annual tax documents, visit our tax forms page.

Still need more information? Contact Us

You can submit your insurance documents online at www.imcovered.com/robinsfcu and entering in your unique identifier. If you do not have your unique identifier, you can email your declarations page to robinsfcu@imcovered.com, fax it to (866) 205-1048, or mail it to:

Robins Financial Credit Union

PO Box 6849

Warner Robins, GA 31095-6849.

Still need more information? Contact Us

Please allow 7 – 10 business days to receive your new card.

Still need more information? Contact Us

If you have received the same card number as your old card, then you will use the same PIN. If you have received a new card number different than your old card, you will receive a new PIN, in a separate envelope, a few days after your card arrives. Follow the instructions that come with the new PIN if you would like to change it.

Still need more information? Contact Us

Please call our 24-hour telephone activation service at 478-923-3773 or 800-241-2405, option 1 to activate your new card. If you do not activate it before you try to use it, your card may be declined. You may also activate your new card in Digital Banking by selecting Activate Card under Self Service options.

Still need more information? Contact Us

You are allowed up to $5,000 per day, whether you use your card with a PIN (Personal Identification Number) or sign your receipt.

If you need to temporarily increase your limits please contact us.

Still need more information? Contact Us

When you use either debit or credit, it will always withdraw the funds from the checking account that the card is linked too (If you have multiple debit cards for multiple shares). Debit requires the use of your PIN number and the funds immediately are withdrawn from your checking account. Credit requires the funds to be placed on hold for a maximum of 72 hours and then the funds are withdrawn from your checking account.

Still need more information? Contact Us

A balance transfer allows you to transfer funds from one of your current credit cards with a different financial institution to a Visa credit card here with Robins Financial.

Information that you will need to do a balance transfer with Robins Financial:

- Name of card issuer that we are paying on

- Address to mail the payoff check (This is typically different than the financial institution's main address)

- Card or account number that we are paying on

- Amount to transfer to Robins Financial

Still need more information? Contact Us

You will first need to contact the merchant directly to cancel any monthly subscriptions, auto payments, or billings. After you notify them that you no longer want to be charged and they continue to bill you, you may be able to file a dispute. Click here for dispute instructions.

Still need more information? Contact Us

Click here to get more information on disputing a transaction.

Still need more information? Contact Us

A provisional credit is posted to your account once we have reviewed your case and have all of the required documentation to process your dispute. However, if we find that more information is needed to process your dispute or we find that you do not have a valid dispute, we will contact you within 3 business days.

Still need more information? Contact Us

New cards are automatically mailed out before the end of the month prior to your current cards expiration. If you do not receive a new card before your current card expires, you can stop by any of our branch locations to have a card issued to you or you can contact our call center to have one mailed out immediately.

Still need more information? Contact Us

Contactless cards are equipped with new secure technology that allows you to make payments without inserting your card at payment terminals. To learn more visit our full Contactless Card FAQ page.

Still need more information? Contact Us

You can withdraw up to $500 per day.

Still need more information? Contact Us

When you use your VISA® debit card to conduct a Signature or “Credit” transaction (for example, when you do not enter your PIN), the merchant sends Robins Financial the amount, usually the purchase total, for authorization. This amount is placed on hold and removed from your available balance immediately. The hold is released after approximately 72 hours or when the transaction clears, whichever comes first. The hold helps determine the available balance on your account.

Still need more information? Contact Us

No, debit card authorization holds only apply to VISA® debit card transactions when you sign your name or do not enter a PIN. For example, a VISA® debit card purchase made at a restaurant or with an online merchant would be treated as a Signature/Credit transaction and would be subject to an authorization hold.

Debit purchases and ATM withdrawals made using a PIN usually subtract the funds immediately from your account (except, for example, when you use your PIN at certain gas station merchants).

Still need more information? Contact Us

Your available balance reflects any authorization holds or deposit holds and is used by Robins Financial to determine available funds when transactions attempt to clear your account. The balance Robins Financial uses as transactions clear is called your available balance and includes all items that have cleared your account up to that point and reflects any items on hold. If your available balance is not sufficient to cover a transaction, Robins Financial may pay the item and charge you a Bounce Protection Overdraft fee (or decline to pay the transaction which may result in a NSF fee). A Bounce Protection Overdraft fee or NSF fee may be charged even though your actual balance indicates a positive amount.

LEARN MORE ABOUT AVAILABLE BALANCE

Still need more information? Contact Us

Using debit card authorization holds helps you better determine the funds you have available for use. This information will help you avoid non-sufficient funds (NSF) or overdraft situations. For example, if you visit an ATM and see that your available balance is $100, you may decide to withdraw $60. Your actual balance may be $200 but $100 is on hold from a Signature/Credit transaction you made earlier in the day. If the debit card authorization hold for $100 was not on hold, your available balance would appear to be $200 and you may have withdrawn an amount (above $100) that would place the account in an overdraft situation when your earlier transaction posted to the account.

Still need more information? Contact Us

No. Debit card authorization holds are utilized so that you can check your available balance and obtain a more accurate picture of the funds that are available for you to spend. You can review your available balance when you review your account online, at an ATM, by phone or at a branch.

Still need more information? Contact Us

No. Some merchants, especially gas stations, hotels and sometimes restaurants, will preauthorize an amount that is higher or lower than the actual purchase amount. For example, gas stations preauthorize transactions for amounts ranging from $1 to $100 because they do not know how much gas you will actually pump in advance of your transaction. If they preauthorize $75, Robins Financial will place a hold for $75 even if your actual transaction is only $45.

Still need more information? Contact Us

You can use your VISA® debit card and select “Debit” and enter your PIN. Or, if you are unable to conduct a PIN/Debit transaction, you can use your Robins Financial credit card to conduct the transaction and avoid the authorization holds.

Still need more information? Contact Us

For Signature/Credit transactions, a $1 authorization is processed to check your card, followed by the finalization of fuel pumped for the full amount which posts to your account. Once the finalization is posted the $1 hold drops. VISA® requires the hold to be released within three (3) business days.

For PIN/Debit transactions, merchants determine the dollar amount of funds held. VISA® allows up to $100, most merchants add $50 to $85, but the amount changes at the merchant’s discretion due to fuel costs and larger tanks on vehicles. Most merchants post signs at the pump stating their practice. VISA® allows merchants a maximum of two (2) hours for sending the finalization of the PIN/Debit transaction. When the finalization posts, the hold is removed from your account.

Still need more information? Contact Us

When you use your VISA® debit card to make reservations in advance, hotels generally will preauthorize an amount equal to an overnight stay, or more, depending on the length of your stay. This will result in a hold on your account for up to 72 hours. When you actually arrive, the hotel will place another preauthorization, often larger than the cost of your stay to cover possible incidental expenses.

The authorized amounts will vary based on VISA® maximum limits and the merchant should have a disclosure that informs you of the hold. These holds will not be removed until the finalization comes through or after a maximum of five (5) days.

One way that you can avoid these large holds is by using your Robins Financial credit card for these types of transactions. Just be sure to pay down your credit card balance using the funds from your checking account.

Still need more information? Contact Us

Online and telephone VISA® debit card transactions are generally processed as Signature/Credit transactions because you do not have the option to enter your PIN. These types of transactions will create an authorization hold.

Still need more information? Contact Us

When merchants preauthorize an amount that is different from the final transaction total, there is a chance that the hold and the transaction will not match and the hold will not release. If the transaction does not match the hold, the hold will be automatically released in 72 hours.

Still need more information? Contact Us

No. Some merchants will not send the final transaction to Robins Financial within the 72 hour timeframe of the hold. In these situations, the hold will drop off and the funds will appear to be available again, however, the transaction still has to post to your account. Unfortunately, Robins Financial has no control over how quickly merchants process their transactions.

The best way to know the amount of funds you have available for use is to carefully track all of your transactions (including checks, automatic payments, deposits and VISA® debit card transactions).

Still need more information? Contact Us

It is not Robins Financial’s policy to remove debit card authorization holds unless an error was made. If an erroneous hold was placed or there are extenuating circumstances that may warrant removing the hold, please contact us.

Still need more information? Contact Us

You can set up automatic transfers from another account, a line of credit or your Robins Financial credit card if you do not have sufficient available funds in your account to cover a transaction. If your transfer account, line of credit, or credit card does not have sufficient available funds, the transaction may be covered by the Robins Financial’s Bounce Protection program.

LEARN MORE ABOUT OVERDRAFT PROTECTION OPTIONS

Still need more information? Contact Us

To sign up for Command Call, please dial 478-923-3773 or 800-241-2405, press 1, press 1 again, to begin using the service. First-time users need only to enter their account number and follow the system prompts to set up an access code.

If you forget your Command Call Access Code, you will need to call our call center for assistance on resetting it. For security reasons, we cannot view your Access Code you have selected but we can reset it at your request.

Still need more information? Contact Us

Command Call is the name given to our audio response system. The system gives you access to your account information by telephone around the clock, at no cost.

To use Command Call, you must be a member of Robins Financial Credit Union and have a Command Call Access Code. Call Command Call at 478-923-3773 or 800-241-2405 and follow the system prompts to set up a personal identification number.

Still need more information? Contact Us

Just call 478-923-3773 or 800-241-2405, press 1, then press 1 again to access Command Call. Follow the system prompts to check your balance, review your latest transactions, and perform transfers as needed.

To receive information about your accounts, you will need to enter your account number and Command Call Access Code, press 1, and then press 3.

To enter in amounts, you will need to enter the amount in dollars and cents, followed by the pound sign (#). For example, enter 3029# to represent $30.29 and 1022# to represent $10.22.

Still need more information? Contact Us

Digital Banking is a service that gives you access to your account information 24/7 by logging in through our online portal. You may log into Digital Banking from our homepage by entering your login information and clicking on the Login button.

First-time users will need to use our New User Form and follow the prompts to register. You can download our Mobile Banking app from Google Play or the App Store to access your Robins Financial account from your mobile device.

Still need more information? Contact Us

It's just another way to verify your identity. Secured Access Codes are sent to you via text message or by phone. It is a one-time use, 6-digit code. Take note that these codes are only good for a short amount of time, so should any issues arise while inputting your code, you may need to request a new one.

Still need more information? Contact Us

If your account has been locked you will need to contact the credit union to be reset.

Still need more information? Contact Us

If you do not know your Digital Banking password, select "Forgot Password" from the Digital Banking login box. Follow the prompts to reset your password.

Still need more information? Contact Us

You may have hidden the share/loan inadvertently. To check, click on "Account Preferences" under "Self-Service Options." Use the toggle button to hide, or make visible any of your shares/loans inside of Digital Banking.

Still need more information? Contact Us

This can occur in multiple circumstances dealing with various settings in your browser. Here are a few troubleshooting techniques:

- Delete any saved passwords, cookies, internet history.

- If you're using a shortcut, or saved link to get to our website, remove the saved URL. Instead, try just searching for Robins Financial Credit Union with Google, or navigating in your web browser to our URL directly, instead of using your shortcut.

- Try using a different web browser- Example: if you're using Internet Explorer instead try using Google Chrome.

- As a final step, reset your password using the "Forgot Password" option.

If the issue still persists, you will need to contact your internet service provider, or some other type of computer support service to further investigate the issue.

Still need more information? Contact Us

Log into your Digital Banking, navigate to the left hand side to the tab that says "Products and Services." Then go down to the tab that says "E-Statements." Once you agree to the terms and conditions you will be set up for e-Statements.

Still need more information? Contact Us

Log into your Digital Banking, navigate to the upper right corner of the homepage; under "Transfer Now" click the tab that says "Enroll in Bill Pay." Once you agree to the terms and conditions, navigate back to the homepage to the left hand side and click on "Products and Services," then "Bill Pay." This is where you will access your Bill Pay.

Still need more information? Contact Us

Log into your Digital Banking and click on the share/ loan you would like the account number for. Then at the top of the header section you will see the word "Details" next to "Transactions". Click on "Details" and the full routing and account number will appear. You will need to have your full 13-digit account number and full 9-digit routing number.

Still need more information? Contact Us

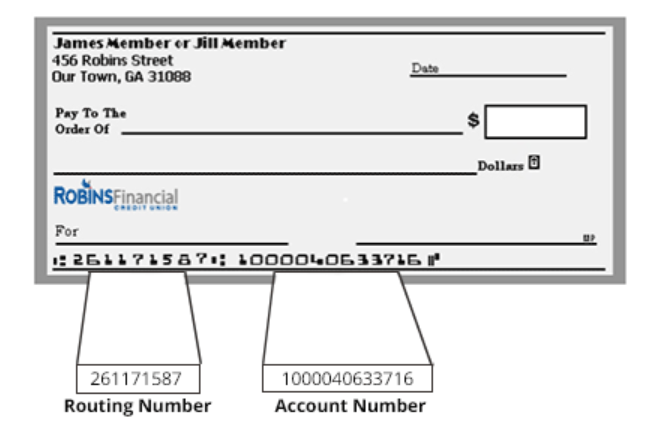

The ABA routing number is a 9-digit number assigned to financial institutions to identify the financial institution upon which a payment was drawn. Routing numbers are sometimes referred to as "check routing numbers," "ABA Numbers," or "routing transit numbers".

Still need more information? Contact Us

The routing number for Robins Financial is 261171587.

Still need more information? Contact Us

To set up direct deposit of your paycheck, check with your company’s HR department to see if your employer offers direct deposit.

Typically, you’ll need to supply just a few pieces of information in order to complete the forms to set up direct deposit to your Robins Financial account(s).

- Robins Financial Credit Union’s Routing Number is 261171587;

- Your checking MICR number or savings MICR number; and

- Account type (for example, Checking, Savings, etc.)

You can find all of this information within Digital Banking. If you are signed up for our digital banking, then you can easily access your account information by logging into your account and clicking on the checking or savings account you are needing the information for. The next thing is to simply click the details button and your Account Number and Routing Number are the first items in the list of details. For more information on how to access this information with detailed screenshots please visit our digital banking guide

If your recurring check is from an annuity, pension or government benefit program instead of from an employer, you can also set up direct deposit of your checks into your Robins Financial Credit Union account(s). Just provide them with the information described above to set it up. You'll save time, and you can access your funds more quickly when they are direct deposited than you can when you deposit a paper check.

Still need more information? Contact Us

Make your loan payments using our online loan payment portal. Click here to register and follow the prompts to register your account. Express Pay allows you to make a one-time payment without registering your account.

Any type of deposit account can be used to pay your Robins Financial loan. You can make a payment to any loan type through the portal, excluding a first mortgage and business loans.

Still need more information? Contact Us

Call 833-886-6110 to make your payments over the phone using our Interactive Voice Response system. The IVR system automatically manages your payment through a series of voice-activated prompts, no need to speak to a live agent! The entire process only takes a few short minutes, and is free to members.

All you need is your account number, the last 4 digits of your Social Security Number, and the routing number and account number for the source of the payment funds.

You can make a payment to any loan type, excluding mortgages and business loans.

Still need more information? Contact Us

Payments made through the online payment portal or Interactive Voice Response system have a maximum payment amount of $2,500. Any payment exceeding this amount will need to be made over the phone with one of our agents.

Note: There is a $3.00 Service Fee for payments made over the phone with an agent.

Still need more information? Contact Us